How to Take Deductions from Annoying to Insightful

There’s been a lot of talk lately within the community about deductions and the horror stories some founders have experienced with distributors and retailers. This article digs deep into deductions to help brands get a better understanding of what they are, why they happen and how to not only get them under control – but also leverage them to understand what’s really going on with trade spend across your retail channel.

What are Deductions?

In the context of the CPG industry, deductions are the preferred method retailers and distributors use to collect their fees from brands in exchange for the service of marketing and promoting their products. These fees are typically deducted from monies owed to the brand for the product provided.

Why Do Deductions Matter?

Deductions are a very real problem for emerging brands that are trying to grow their presence on store shelves. Why? Because the deduction process that has evolved over the years allows retailers and distributors to make or hide mistakes (intentionally or not) with little downside risk. Not surprisingly, fees collected via deductions by retailers and distributors are often higher than expected (or worse, not expected at all) by the brand. And they can get overwhelming fast. Imagine fees collected by SKU, or even by transaction…with a limited number of hours in the day, it can become impossible to keep track, and the sad truth is most brands don’t even bother while they lose a good portion of their profits needlessly.

Various studies have shown that anywhere from 10-25% of deductions, on average, are found to be preventable or invalid.

While getting on the shelf can feel like a great step forward, not paying enough attention to deductions can quickly and easily take you 10 steps back in profit.

But aside from the likely negative impact on your margins, perhaps the most important loss from inadequate deduction management is the ability to see the complete picture of your business. Deductions themselves carry a great deal of intelligence about your retail business once you’ve put all the pieces together. There are intricate details hidden in those different charges that could be telling a bigger story (or revealing a bigger problem) in your retail channel and answering questions like:

- “Is my business growing proportionally or disproportionately compared to my investments?”

- “How does the performance of my regional managers compare?”

- “What is the true profitability of a retailer or a product line for me?”

- “Are my distributors killing me on forward buys?”

- “How effective was a promotion, and what was its true impact on my top and bottom lines?”

- “Do I have issues with my managers rubber-stamping excessive marketing expenses?”

- “Am I losing my shirt to invalid claims?”

None of these questions can be answered with any certainty without a thorough understanding of the charges being deducted from you.

What Can I Do About Deductions?

A brand’s revenue and number of retail customers will typically dictate the best approach to manage deductions, ranging from in-house to fully outsourced through a turnkey service like Promomash.

- Brands under $2M may not yet be at the point where significant external (or even internal) resources are needed to handle deductions. This ebook from Promomash dives into recommended best practices and processes for deduction management for brands at any stage.

- For brands with several customers or revenues over $2M it starts to make economic sense to have a competent deduction management process in place to start mitigating the margin hit. At the point a brand starts feeling the pain due to overwhelm with the number of deductions, they should consider outsourcing some or all of their deduction process.

What Does a Deduction Management Process Look Like?

Whether deduction management is in-house or outsourced, the following are basic, necessary steps that must be taken to get a proper understanding of your deductions. It’s important to note that most deduction management services on the market will not be able to assist with every step in this process. [For a completely outsourced experience, look to Promomash as the only turnkey, end-to-end service on the market designed and priced for emerging CPG brands.]

-

Capture

Having a mechanism to capture and correctly enter deductions into a system, database or even spreadsheet is the first step towards organizing and making sense of the madness. An outsourced deduction management service will gather, scan, and organize deduction invoices into one single database so that no data entry is required.

-

Categorize

Once deduction invoices are captured, they must be reviewed to understand the reason behind the charge, and then categorized accordingly. Depending on the retailer or distributor, the reasons for charges will vary widely – anything from standard commercial items like payment terms, to a whole range of trade marketing expenses and charges for deviations from contract terms like shortages and spoilage. As a brand gains a few customers the complexity can quickly get out of hand, as each customer uses different reason code systems to characterize their deductions. They might also provide them to you in a different format than they would the next customer. The benefit of a deduction management service is that there is no need train a team of specialists to track and understand each customer’s unique system of reason codes – each deduction is categorized based on each customer’s policies and reason codes using someone else’s economies of scale. Not all deduction management services work with all customers, however, so this is important to note when looking for a service. [Promomash works with all major retailers and distributors that work with emerging CPG brands.]

-

Validate

Once deductions have been captured and categorized, the analysis begins to understand why the charge occurred in the first place and whether it’s valid. Technology alone can’t go this far (yet) so human eyes are still required for this step. The Promomash deduction management service is unique in the market in that it includes a team of human experts who review and validate each deduction invoice. -

Dispute (if necessary)

If there are any deductions found to be invalid, you are within your right to dispute it and request a credit or refund – and as mentioned earlier in this article, those amounts can really add up. Most brands just don’t have the time to get to step 1, let alone have the time to follow with customers on deduction disputes. With Promomash, this too is included as part of the service offered.

What Insights Can a Deduction Management Process Provide?

After all is said and done, and you’ve invested in a proper deduction management process, what’s next? How do you take all of that data and extract real, actionable business insights from it? The answer to that depends on how fully automated or outsourced your process is. Here we’ll provide some examples of the type of reporting Promomash is providing clients on their deductions to give you an idea of the possibilities.

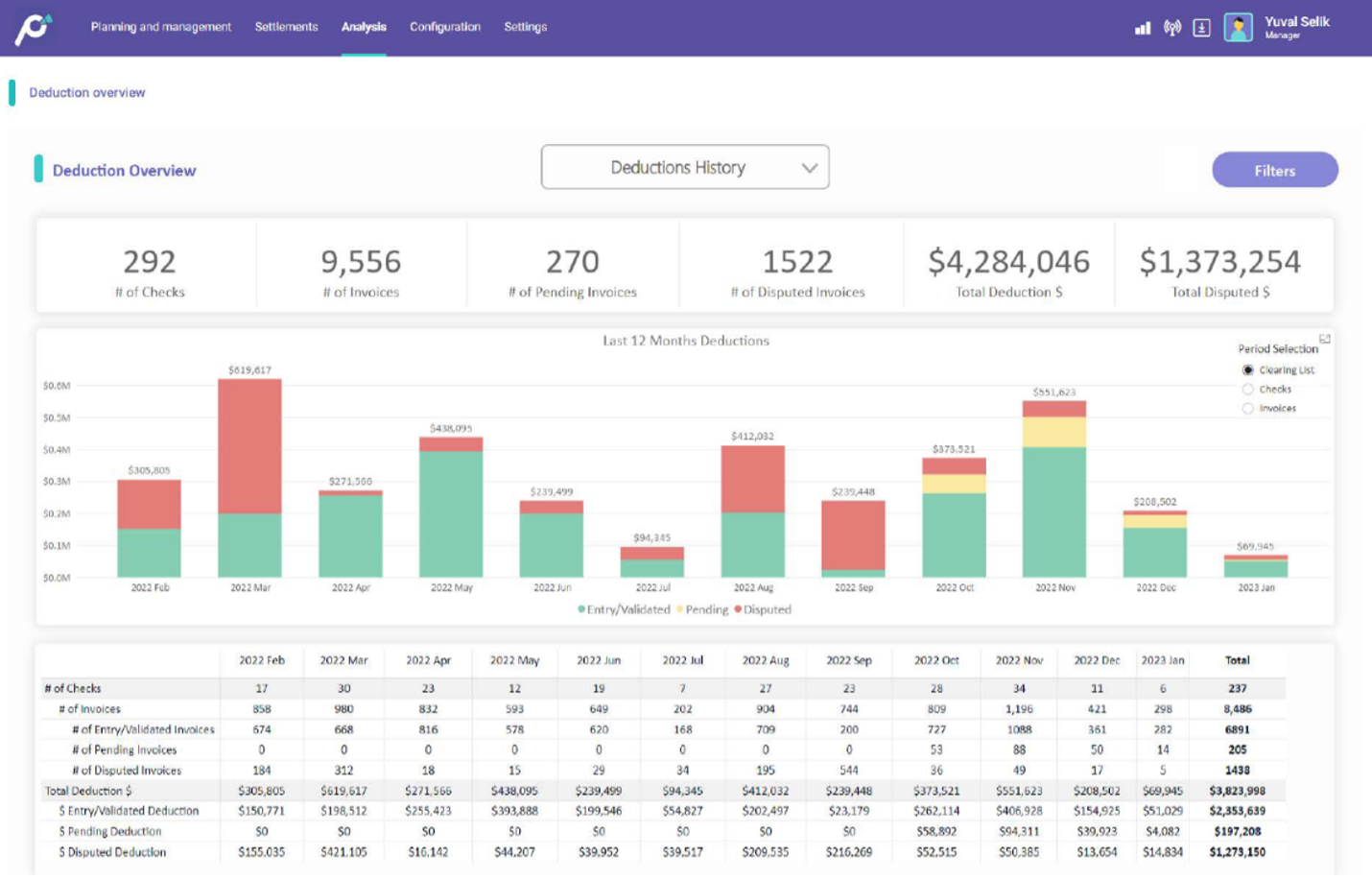

Deductions History & Status Overview

This dashboard provides an overview of all the deduction data that’s been collected and processed for the last 12 months, broken down by status (green=validated, yellow=pending, red=disputed). You can also see the total number of deductions processed in quantities and dollar amounts across the top. In this example, the dollar amount disputed of over $1.3M represents a whopping 32% of deductions – well over the top-end average of 25%.

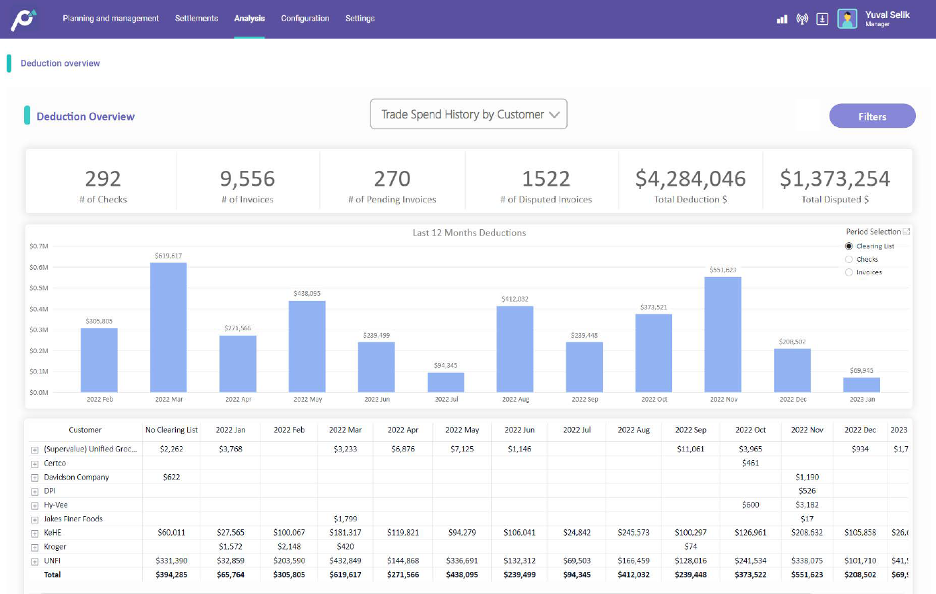

Trade Spend History by Customer

Here you’ll see the same data as above but sliced by customer, revealing how trade spend is distributed throughout the year across all customers. In this particular example, filters are available to report on all customers or one single customer.

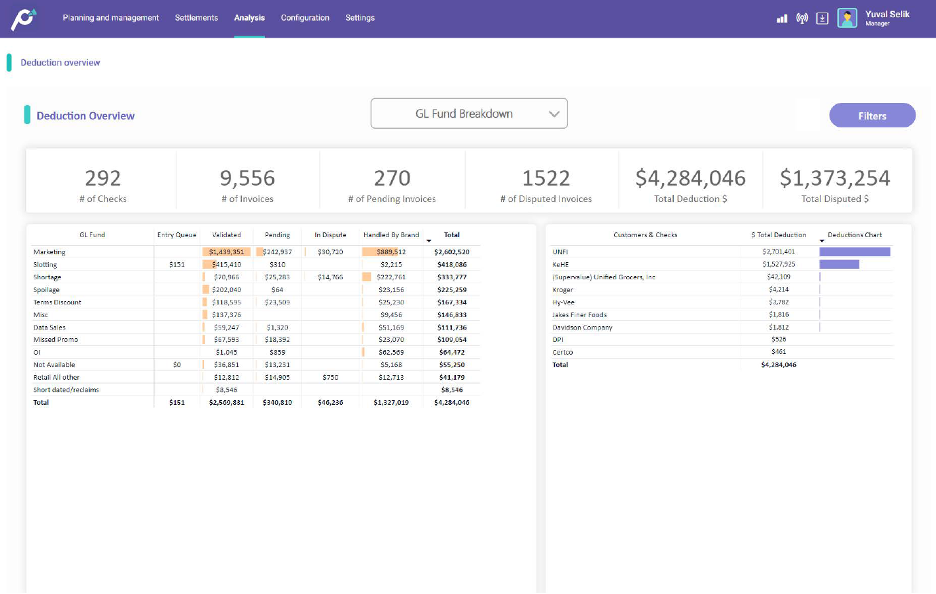

GL Fund Breakdown

This view provides a breakdown of where trade spend landed by GL Fund, or reason. You can see how much in deductions is validated, pending, and in dispute for each GL Fund. In this example, you can see a significant portion of charges for marketing and spoilage being disputed. To the right, you can also quickly see how totals break down by customer.

Taking the First Step

Wherever you are in your CPG journey towards retail distribution, Promomash can help provide guidance on the best approach and set you up with services that make sense for your business. To learn more, visit www.promomash.com or contact us.