How Will Sampling and In-Store Demos Look Post-COVID?

In-store food sampling and product demos are coming back. Here’s how we think they will change – and how CPG brands can prepare now.

One of the first industries to be directly and catastrophically impacted by the advent of the COVID 19 pandemic was food and beverage product demos (tastings, samplings). In March 2020, it certainly made sense for stores to quickly opt out of having non-employees appear in their stores (with no ability to screen or otherwise control those personnel) to prepare and hand out open samples of products to the shopping public. Costco was the one of the first major stores to halt all demos in early April; Whole Foods Market followed suit shortly after that, and the rest of the industry went along like dominoes. Thousands of brand ambassadors and sample servers were suddenly and without warning unemployed.

As the months have worn on and the country has been on lockdown, significant progress has been made in both understanding the virus and in implementing measures to mitigate its further spread. Businesses are slowly but surely being allowed to reopen, and Costco again is taking the lead, announcing that samples would be returning to their stores in mid-June. Other banners have taken the cue and smaller chains like Lassens in Southern California have already given the green light. Overall the return of demos is likely to proceed the way that CDS has indicated they will re-enter Costco – mirroring the phased approach in their communities and focusing on locations in states that have reopened for business. In any case this is of course encouraging news for the demo industry.

Will we be able to just come back and start doing demos as we always have before? The answer to that question is a decisive “no.”

Demos will come back, but they will have to be different – at least for the foreseeable future. It's safe to say that shoppers will no longer be quick to pick up open samples and pop them into their mouths. But thus far, retailers have been a bit vague about further details of exactly how demos will be changing.

One thing we know for sure is that changes will be required in order to perform demos now, so CPG brands and manufacturers need to assess whether it makes sense for them to reengage, and if so, what it will take and how much it will cost. If you're a CPG brand facing this decision, we'd like to offer some guidance regarding what we see as the most important factors to consider.

Why do demos in the first place?

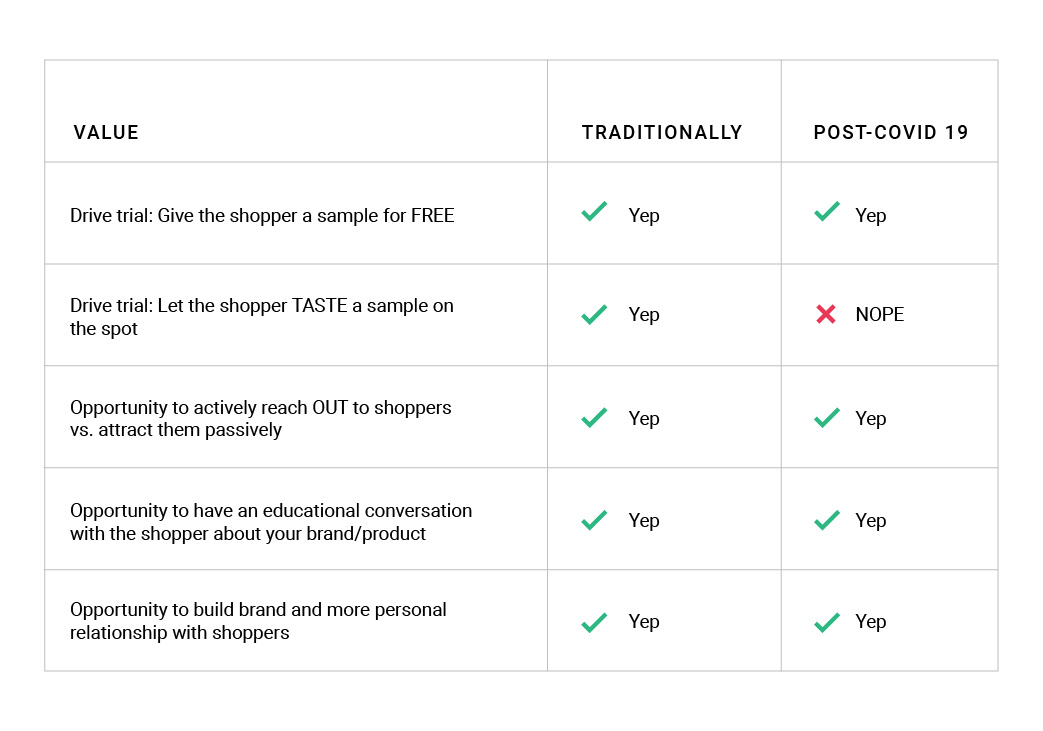

We believe that in order to make the best decision regarding one’s demo program, it’s a good idea to step back and reconsider what the value and cost of doing demos is.

Since Promomash has more data than most any other company out there when it comes to managing demos, we’re in a pretty good position to summarize both the value of demos past, and compare those with the prospect of demos in a post-COVID 19 world. The following table covers what we think are the most important considerations:

What the table shows is that most of the VALUE of demos post-COVID 19 are still present. The only thing that you can’t do is watch the shopper put the sample in their mouth (and document their reaction, if you were doing that before). That seems an inconsequential change… so, to summarize, if you already know why you’re doing demos and have a feel for how much value they provided, your thinking shouldn’t change much if at all. If, on the other hand, you haven’t quantified these rationales before, it’s certainly worth doing now. We've seen countless brands with products that best lend themselves to demos see a 3X, 5X, even 10X return on their investment because of their influence on repeat purchases over time.

What’s the catch?

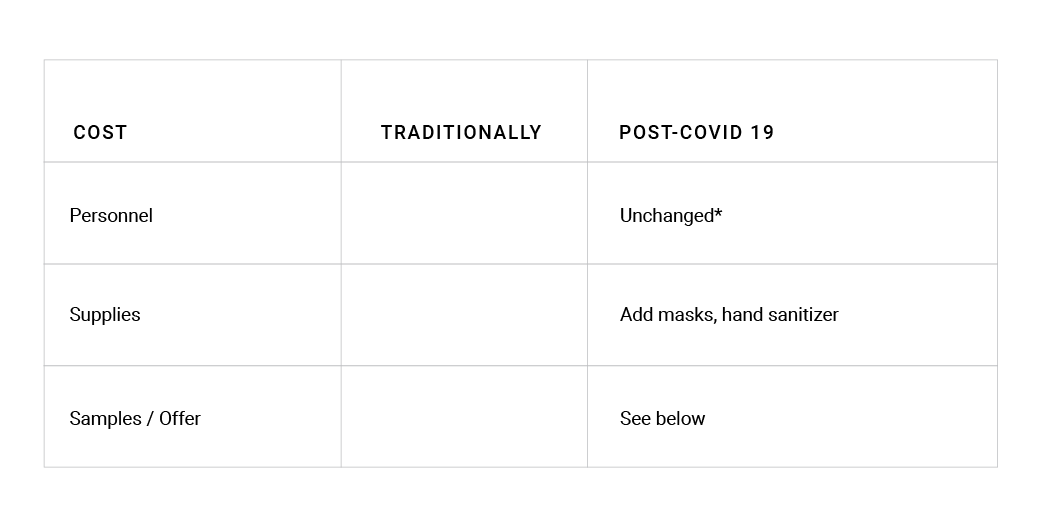

The catch is that in most cases it’s going to cost more to do demos. Let’s look at the simplified considerations:

While personnel costs are largely going to be unchanged, the asterisk (*) means that some short-term costs to train/update/certify reps on food handling and safety may be needed. Masks and sanitizer are probably going to be minor additions to supplies. But the big ongoing cost change is most likely going to be in the samples themselves, depending on your product. Open-cup samples are out - individual sample-size packs are in. This may turn out to be the make-or-break for many brands; those who do not already have sample sizes will have to either arrange that, or be faced with offering full single-serves if they have those. If actually handing out a sample is still the objective, the cost of a demo may indeed increase. If the additional tool-up for samples turns out to be cost-prohibitive, or it gets too expensive to hand out larger samples of your product, one creative option might be to transform the objective of your demos away from actual tastings, and towards driving engagement and trial by handing out coupons.

Is it a brave new Demo World?

Nah. All indications are that everyone – retailers, brands, and shoppers – all want demos to return, and that with some straightforward changes, they are already in the process of coming back. Some demo companies have actually stated that the new changes in demo procedures have been a long time coming, and that the increased focus on food safety will be a net benefit to all. We agree.

The most important thing for CPG brands now revisiting their demo programs is to look beyond the cost(s) on demo day, and factor in the lifetime value created by their smiling ambassadors. This has always been the difference between brands who have been able to use demos as an effective driver of loyal, long term sales and those who have not.

Hear more on this from the brand and agency perspective...

If you want to get some great expert advice on how to approach demos as they come back, check out our on-demand webinar, Supporting Retail Growth with Demos in the Post-COVID Era. Our friends Jessica Shields from Health & Fitness Activations and Tina White from Brainiac Kids® shared plenty of experience and best practices with a little fun thrown in. Click here to watch it now.